What You Need to Know Before You Purchase Reverse Mortgage

What You Need to Know Before You Purchase Reverse Mortgage

Blog Article

Unlock Financial Flexibility: Your Guide to Getting a Reverse Mortgage

Understanding the complexities of reverse mortgages is important for property owners aged 62 and older seeking financial liberty. As you consider this alternative, it is critical to comprehend not just exactly how it works yet additionally the ramifications it may have on your financial future.

What Is a Reverse Mortgage?

The basic appeal of a reverse home loan depends on its prospective to boost financial versatility throughout retirement. House owners can use the funds for different objectives, including medical expenditures, home improvements, or daily living expenses, hence providing a security web during a crucial phase of life.

It is essential to comprehend that while a reverse home mortgage permits increased money circulation, it additionally decreases the equity in the home in time. As rate of interest gathers on the outstanding funding equilibrium, it is essential for potential borrowers to thoroughly consider their long-lasting monetary strategies. Consulting with an economic expert or a reverse mortgage specialist can offer useful understandings right into whether this choice straightens with a person's economic objectives and circumstances.

Eligibility Requirements

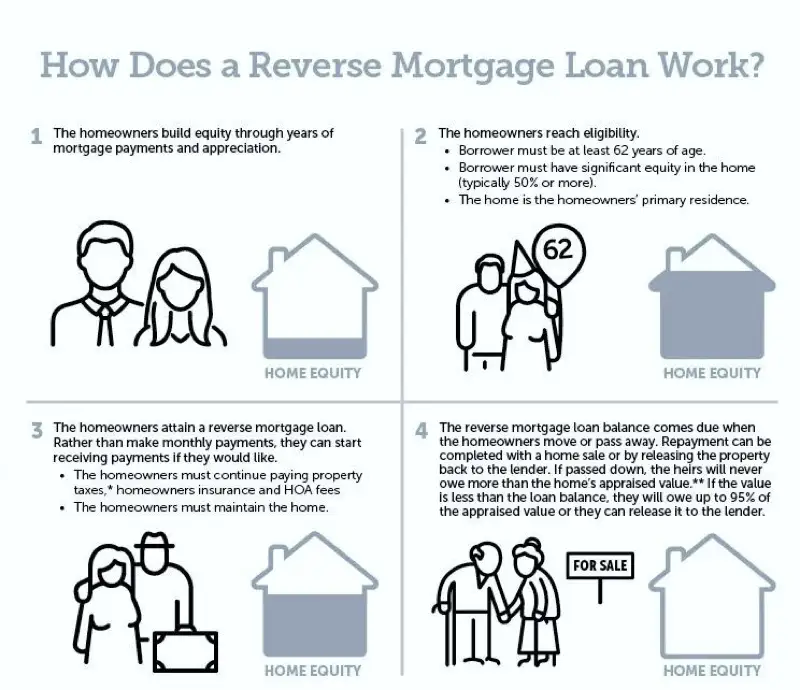

Understanding the eligibility requirements for a reverse mortgage is vital for homeowners considering this financial alternative. To certify, candidates need to go to least 62 years old, as this age criterion permits elders to accessibility home equity without month-to-month home loan payments. Additionally, the homeowner must inhabit the home as their main dwelling, which can consist of single-family homes, particular condominiums, and manufactured homes meeting details standards.

Equity in the home is another essential requirement; home owners normally need to have a significant quantity of equity, which can be figured out with an appraisal. The quantity of equity offered will directly affect the reverse home mortgage amount. Candidates should show the ability to keep the home, including covering residential property taxes, house owners insurance, and maintenance prices, ensuring the residential property remains in great problem.

Additionally, potential consumers must go through an economic assessment to assess their revenue, credit rating, and total financial circumstance. This evaluation aids lenders identify the candidate's capacity to fulfill ongoing obligations associated to the building. Meeting these requirements is important for protecting a reverse home mortgage and ensuring a smooth financial shift.

Benefits of Reverse Home Loans

Many advantages make reverse home mortgages an enticing alternative for elders looking to enhance their financial flexibility. purchase reverse mortgage. One of the primary advantages is the ability to transform home equity right into cash money without the demand for month-to-month home mortgage settlements. This function enables senior citizens to gain access to funds for different needs, such as medical expenses, home improvements, or daily living prices, therefore relieving economic stress and anxiety

In addition, reverse home loans offer a safeguard; elders can proceed to reside in their homes for as long as they meet the loan needs, cultivating stability during retired life. The earnings from a reverse home loan can also be made use of to postpone Social Safety and security benefits, possibly leading to higher payments later on.

Moreover, reverse mortgages are non-recourse car loans, meaning that borrowers will certainly never ever owe greater than the home's worth at the time of sale, securing them and their heirs from economic liability. The funds received from a reverse home mortgage are typically tax-free, including another layer of economic relief. On the whole, these benefits placement reverse mortgages as a functional service for elders seeking to boost their financial scenario while maintaining their treasured home environment.

Costs and Charges Involved

When thinking about a reverse home mortgage, it's vital to know the various costs and charges that can affect the total financial photo. Comprehending these expenditures is crucial for making an informed decision about whether this monetary product is ideal for you.

Among the key prices related to a reverse mortgage is the origination fee, which can vary by loan provider however normally ranges from 0.5% to 2% of the home's assessed value. Furthermore, house owners must visit this page expect closing expenses, which may include title insurance, appraisal fees, and credit scores report charges, generally amounting to a number of thousand bucks.

One more considerable expenditure is mortgage insurance coverage costs (MIP), which protect the lender versus losses. This charge is usually 2% of the home's worth at closing, with an ongoing annual costs of 0.5% of the continuing to be finance equilibrium.

Finally, it is very important to think about continuous expenses, such as real estate tax, home owner's insurance, and upkeep, as the customer remains liable for these costs. By thoroughly evaluating these prices and fees, homeowners can much better evaluate the economic ramifications of seeking a reverse home loan.

Steps to Get Going

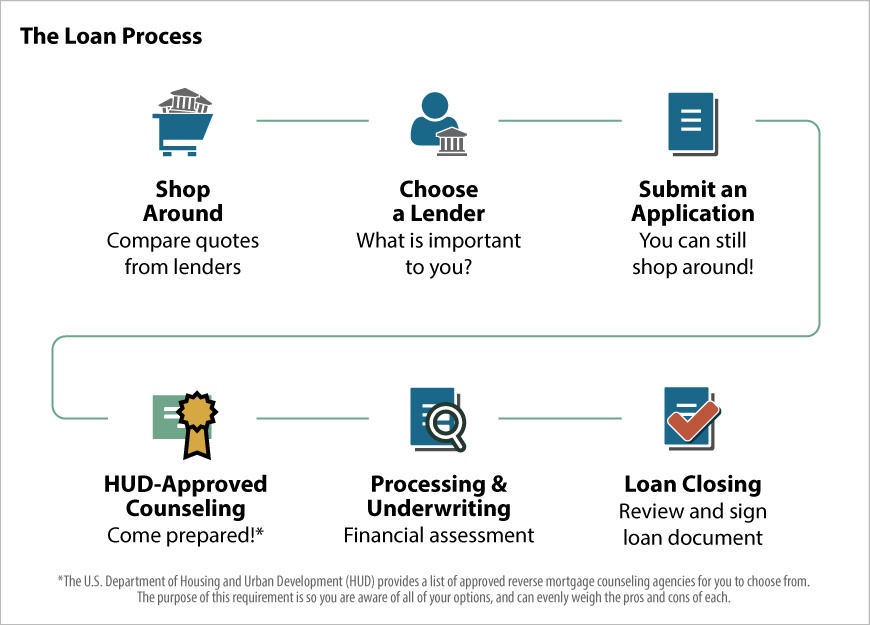

Getting begun with go to this web-site a reverse mortgage includes numerous key actions that can aid improve the procedure and guarantee you make informed choices. Examine your economic situation and identify if a reverse home mortgage straightens with your long-term goals. This includes examining your home equity, existing debts, and the requirement for extra revenue.

Following, study various lenders and their offerings. Try to find reputable institutions with positive evaluations, transparent charge structures, and affordable rate of interest prices. It's important to contrast conditions and terms to find the best fit for your needs.

After selecting a loan provider, you'll need to complete a comprehensive application process, which generally needs paperwork of earnings, assets, and home details. Engage in a counseling session with a HUD-approved therapist, that will certainly supply insights into the implications and responsibilities of a reverse home mortgage.

Verdict

To conclude, reverse home loans provide a practical option for seniors looking for to improve their monetary stability throughout retired life. By converting home equity right into obtainable funds, home owners aged 62 and older can attend to different financial demands without the stress of regular monthly repayments. Recognizing the ins and outs of qualification, benefits, and associated prices is necessary for making informed choices. Cautious consideration and preparation can result in improved lifestyle, guaranteeing that retired life years are both safe and fulfilling.

Understanding the ins and outs of reverse home mortgages is vital for home owners aged 62 and older seeking economic freedom.A reverse home loan is an economic best site product created largely for property owners aged 62 and older, permitting them to transform a portion of their home equity into cash money - purchase reverse mortgage. Consulting with a financial consultant or a reverse home loan expert can give valuable insights right into whether this alternative straightens with an individual's financial goals and scenarios

In addition, reverse mortgages are non-recourse fundings, suggesting that consumers will never owe more than the home's value at the time of sale, safeguarding them and their beneficiaries from monetary responsibility. On the whole, these advantages placement reverse home mortgages as a practical solution for seniors looking for to improve their economic circumstance while preserving their treasured home setting.

Report this page